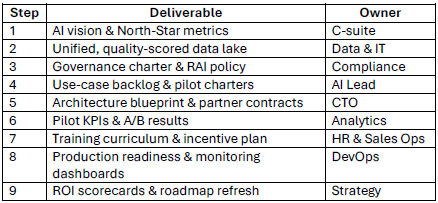

Practical steps to move from "talk" to tangible outcomes

AI is no longer optional for brokers competing for sophisticated, data-hungry clients. The nine steps below translate strategic intent into an executable roadmap—sprinkling in where a data-platform partner like AgencyKPI powers progress quietly.

Start by defining the handful of metrics AI must move: organic growth, placement ratios, loss-ratio improvement, or operational expense. Tie each objective to one or two compelling use cases (e.g., intelligent remarketing, predictive cross-sell, automated bordereaux validation).

Tip: Workshop “AI North-Star metrics” with executive, analytics, and frontline stakeholders to avoid pet-project drift.

Clean, granular data is non-negotiable. Catalog source systems (AMS, CRM, carrier portals, spreadsheets) and map data health. AgencyKPI’s normalization engine can absorb carrier data alongside your AMS data. After broadcasting hygiene actions from the AMS data, create a single analytics layer ready for model training—without months of custom ETL.

Include business team, IT, underwriting, compliance, and change management leads. Draft policies for data privacy, model explainability, bias testing, and human-in-the-loop sign-off—especially as new regulations (e.g., California’s 2025 law limiting AI-based claim decisions) emerge www2.deloitte.com.

EY’s 2024 survey found 83 % of insurers favor projects that deliver near-term ROI ey.com. For brokers, high-leverage starters include:

Select no more than three pilots; prove value in < 6 months.

Adopt modular architecture: core data lake → feature store → model services → UX layer. Platforms like AgencyKPI can sit at the data/analytics tier, feeding models with cleaned, carrier-aligned performance metrics while surfacing dashboards that show lift and leakage—without forcing a rip-and-replace of your AMS.

Run A/B pilots against control groups. BCG research shows AI-powered sales agents boost conversion and trim acquisition cost when embedded in existing funnels bcg.com. Track uplift in revenue per client, average handling time, or loss-ratio differentials. AgencyKPI’s benchmarking views can give pilots an external performance baseline.

Successful brokers pair tech with talent:

Deloitte flags scaling—not launching—as the critical hurdle for insurance AI in 2025 (www2.deloitte.com.) Bake iterative cycles into your operating rhythm:

Large brokers that treat AI as a step-by-step change-management journey—not a silver bullet—are already seeing measurable gains. By fusing disciplined governance with a data engine such as AgencyKPI, you can convert AI ambition into sustained advantage.

The firms that act now will define the new baseline for service and growth. If you’d like to compare notes on your own roadmap—or see how a unified data layer can quietly power each of the steps above—reach out. I’m always happy to swap ideas and explore where AgencyKPI’s analytics muscle might remove friction and accelerate results. Let’s talk about turning your AI vision into measurable wins.